- Mutlu Yaşam Alanları Sunuyoruz!

- +90 224 248 56 66

- info@dumanlargroup.com.tr

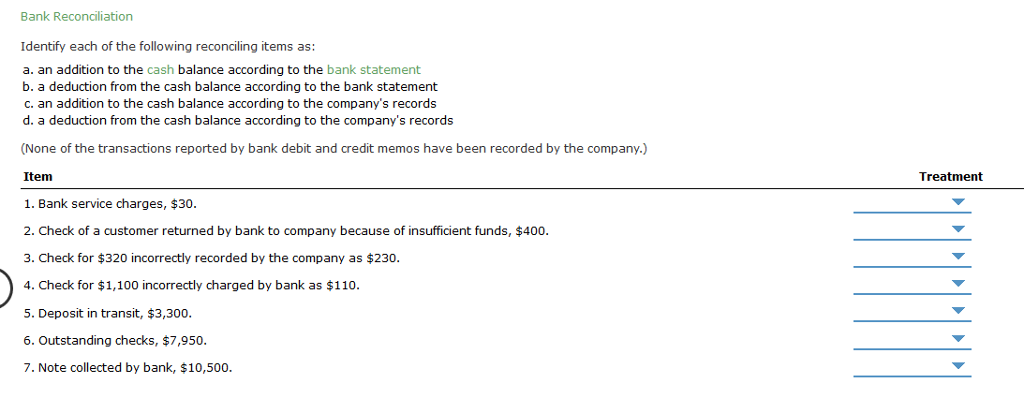

MSHDA Financing Standards and you may Recommendations to own MI Lenders

Brand new Zealand’s #step 1 origin for independent home loan recommendations

9 Aralık 2024Navigator Holdings Ltd. Declares Imaginative Gender Range Connected Loan Facility Arrangement

9 Aralık 2024Searching to acquire property in Michigan? The brand new Michigan State Housing Innovation Power, MSHDA, loan system is the key to making one to purpose attainable. Navigating the loans Alpine realm of mortgage brokers is perplexing, but MSHDA is designed to describe the method.

Whether you’re enduring a down-payment otherwise trying to lower attention rates, these types of applications are made to provide rewarding assistance. Of the knowing the MSHDA financing criteria, you’ll end up best happy to benefit from this type of potential and you will action closer to reasonable homeownership.

Why are MSHDA Finance Convenient?

A portion of the aim of MSHDA home loans will be to create homeownership sensible and you will doable for Michigan residents. These types of money give financial assistance to basic-date homebuyers and people who might not have extreme savings to own a down payment. They help render homebuyers with:

- Lower rates: Of several MSHDA financing incorporate lower-than-average interest rates.

- Downpayment recommendations: This type of applications have a tendency to bring loans to pay for off repayments and you will closure will set you back, a number of the most significant obstacles for new buyers.

- Simplistic app processes: MSHDA deals with regional lenders to ensure an easier, significantly more simple app process.

Sort of MSHDA Loans

MSHDA even offers several financing in order to appeal to various other needs. Here is a simple rundown of the variety of MSHDA software:

- MI Mortgage: The MI Home loan is available so you’re able to first-date homebuyers and you will recite buyers for the designated targeted components. It gives gurus such as lower rates of interest, even more lenient qualification standards, and you can down-payment recommendations.

- MI Home loan Bend: A versatile alternative versus MI Mortgage, right for first-some time and recite consumers. To the MI Mortgage Flex, underwriting is concentrated only into certified borrowers’ possessions, credit, and you may income as opposed to the entire family.

- Down payment Assistance (DPA) Program: Provides financial help, doing $10,000 for your deposit and you may settlement costs. Have to be in addition to an excellent MSHDA MI Financial first-mortgage (FHA, RD Protected, otherwise Antique).

- Financial Borrowing from the bank Certificate (MCC):The brand new MCC program actually financing but an income tax borrowing you to definitely can save you cash on their government taxes. Licensed homeowners can also be borrowing 20% of their annual mortgage attract reduced against the year-end tax responsibility.

MSHDA Mortgage Criteria and Eligibility Guidance

When exploring domestic-to invest in possibilities in the Michigan, MSHDA loans give certain talked about masters. Thus, how can you know if you be considered? Let us break apart new MSHDA standards.

Money Limitations

To help you be eligible for a keen MSHDA loan, your earnings need fall inside certain restrictions. This type of limits will vary of the county and you may domestic dimensions. By the adhering to these types of money limits, MSHDA means that assistance is brought to those who are in need of it extremely. Learn more about the newest 2024 income constraints here.

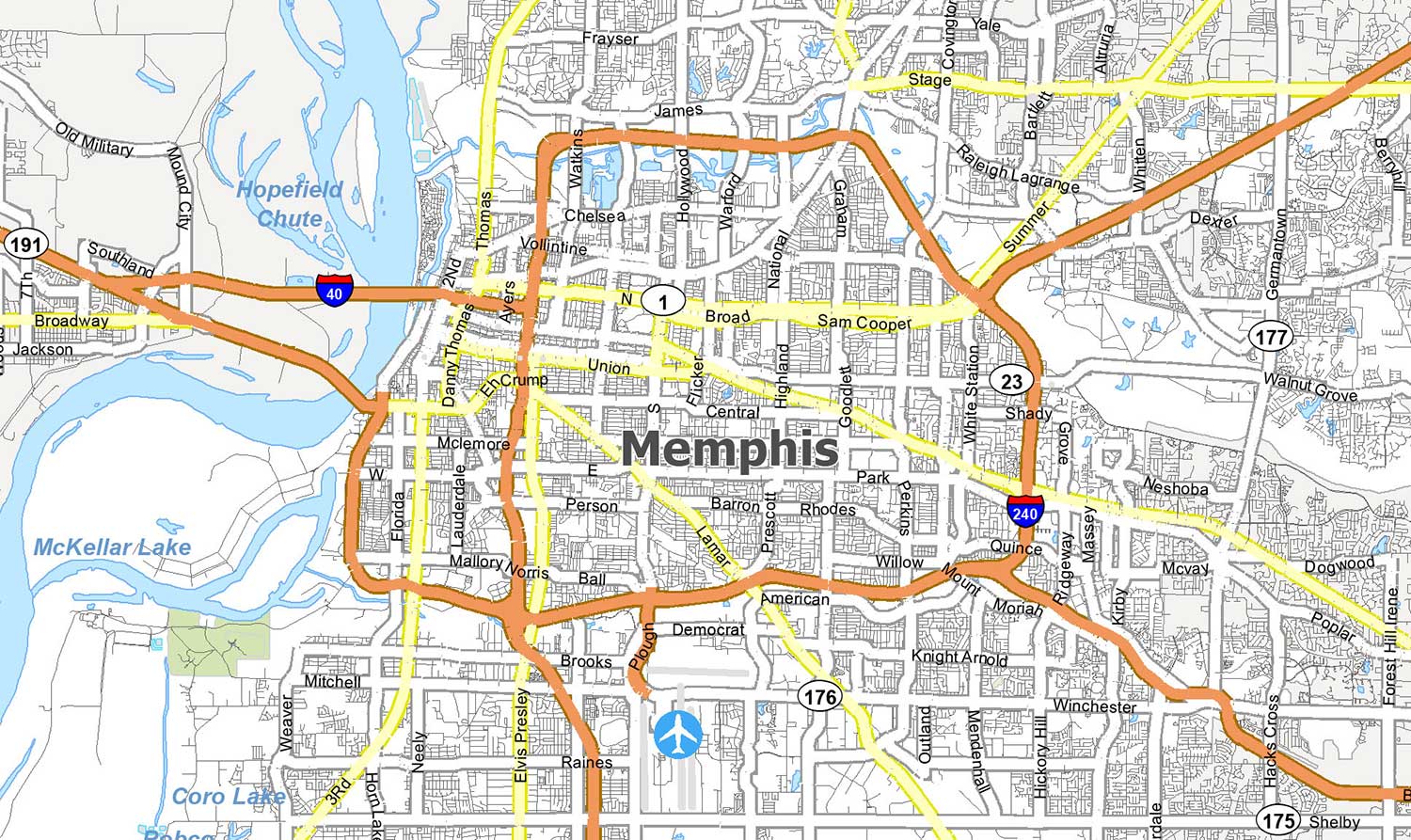

- County Variations: Additional areas inside the Michigan features different money restriction limits. Take a look at certain limitations on county in which you plan to get.

- House Proportions: The amount of money limits change with regards to the number of people in your loved ones. Huge homes typically have large money hats. Including, when you look at the Macomb County, the funds limit from inside the a-1-dos people family is $95,900, and also for a 3+ individual family its $110,285. Every individuals surviving in our home avove the age of 18 have to be eligible for the mortgage.

Conversion process Price Restrictions

Sales speed limitations would be the maximum prices for residential property bought using MSHDA’s guidelines apps. This type of restrictions make sure that house funded by way of MSHDA are nevertheless close at hand for those who meet the requirements. To possess 2024, product sales rates maximum across the every area inside Michigan was $224,500.

- Share Standards: To be eligible for advance payment guidance, individuals need lead at least 1% of your own transformation rates (merchandise enjoy)