- Mutlu Yaşam Alanları Sunuyoruz!

- +90 224 248 56 66

- info@dumanlargroup.com.tr

You can expect a certain service to possess homeowners one to believe it have satisfied brand new 80% loan-to-worth metric

I suggest a disclosure into the one adverts piece you to claims “Other down rates mortgage apps is offered”

13 Aralık 2024Mediocre mortgage balances exceed $one million in 47 towns during the 2024

13 Aralık 2024Every year a vast amount of people promote otherwise re-finance its possessions. Very, if not all ones deals are an easy range goods having an assessment. It’s become an observed and you will approved part of a genuine home transaction. Vendors often find on their own trying to entice the professionals so you’re able to make sure that they aren’t overspending or underselling property.

Particular will additionally make the second step that assist your file problems together with your mortgage lender

But this shouldn’t be truly the only need to obtain an appraisal. There are many different in other cases in the event that characteristics out-of an official, separate real estate professional you’ll be useful.

Acquisition of a house.Regarding to order a different sort of family, typically the most popular issue is figuring out just how much the true home is worth, so you’re able to generate a genuine promote. A professional assessment declaration did because of the a professional, state-formal appraiser can present you with a goal, third party thoughts off a great property’s economy really worth. Score an assessment today, to getting comfortable you are providing a good price towards assets.

- Refinance otherwise Rating a home Equity Mortgage.If you would like combine expenses, enjoys an educational costs to pay, or simply just have to tap into the fresh new collateral of your house, you may need a separate mortgage one sometimes demands an alternative appraisal of the property.

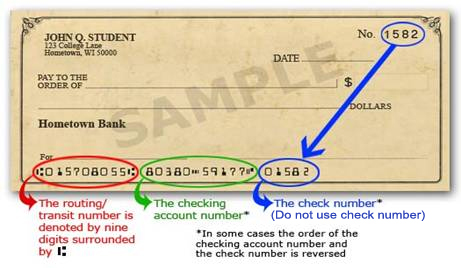

- PMI Removal.Private Mortgage Insurance rates otherwise PMI, is the supplemental insurance coverage a large number of loan providers ask home buyers so you can purchase in the event that count are loaned is more than 80% of your property value the home. Very often, this a lot more percentage was collapsed toward month-to-month mortgage payment and was rapidly shed otherwise missed. This can be unfortunate given that PMI will get a lot of if leftover balance of loan dips less than it 80% top. During the 1998, the usa Congress introduced a legislation (the homeowners Security Work regarding 1998) that requires lenders to eradicate the new PMI repayments in the event that mortgage-to-well worth ratio standards were came across.

Our very own assessment service provides you with a statement regarding the house value. The costs of these services have become usually retrieved in just a couple months of not paying new PMI.

A divorce or separation can be a very rough time for both sides on it, in fact it is have a tendency to further complicated of the difficult decision away from “Which contains the house?” Brand new courts wouldn’t always push the fresh events inside it so you’re able to “buyout” one other party’s appeal, nonetheless it may yet not acquisition the profit of the house very both sides gets the same show of the equity. No matter what situation, it’s best to invest in an assessment so each party try completely aware of what the real elizabeth page.

In case the functions want to promote the home, they will provides a much better idea of exactly what speed to create. Subsequently, in the event that a beneficial “buyout” ‘s the selected solution, both sides usually feel just like obtained obtained a reasonable analysis.

Property Liquidation.The increasing loss of someone close is not an easy topic to manage. Paying down a property out-of a passing, otherwise probate, tend to need an appraisal to determine Reasonable Market value into residential property inside. The fresh new ethics supply in the Consistent Requirements out-of Elite Appraisal Practice (USPAP) attach us which have privacy, making sure the newest maximum level of discretion.

More Americans do not have dedicated estate coordinators or executors to handle these problems. In most cases, property or any other property makes up about good disproportionate express of your overall property value.Right here also, a keen appraiser can help. The first step during the very getting rid of a home is to discover its true value. In which home is in it, the appraiser might help dictate the genuine really worth. At this point, fair preparations can easily be gained among disputing activities. Individuals walks aside knowing they will have acquired a good contract.

Relocation.We understand pressure a part of an individual relocation. We capture great worry inside the setting-up a handy fulfilling returning to the appraisal examination. Throughout the all of our thorough examination, we remind transferring readers to incorporate enter in towards self-confident characteristics of their possessions in addition to factual statements about people present sales or posts within people that they wanted noticed.

Renovations one Include Worthy of.Before you sell your house, there are numerous decisions becoming generated. First of all, you want to know just how much to offer they getting. Make sure you remember there is certainly almost every other incredibly important concerns which need responding, can it be best to color the entire domestic before you could sell it? Any time you setup one to 3rd bathroom? If you done the kitchen upgrade? Everything you do to your property will get an impact on the really worth. Regrettably, only some of them keeps an equal effect. When you are a kitchen remodel will get improve attractiveness of property, it may not put nearly sufficient to the significance so you’re able to justify the expense.

Offering a home

If you choose to offer your house your self otherwise make use of the assistance of a realtor, a professional appraisal can help you build a far greater knowledgeable choice whenever determining the price Indiana personal loans. In the place of a representative, an appraiser has no vested interest in what amount our home sells for. It’s easy for them to step up and provide you with the fresh advice to help you build your decision. Appraiser charge derive from efforts doing the new statement and you will perhaps not a share of your own transformation price. So trying a specialist appraisal can often help property owners result in the most useful decisions on investing their house and you may form a good conversion process price.